Quick Highlights:

- 63 capital goods for lithium-ion battery manufacturing exempted from customs duty.

- Full duty exemption on cobalt powder, battery waste, and key minerals.

- 35 additional EV battery machinery items added to duty-free list.

- Battery recycling boosted with zero duty on lithium-ion battery scrap.

Union Budget FY27 — EV Batteries May Get Cheaper

The Union Budget FY27 has delivered a major boost to India’s electric vehicle ecosystem, and honestly, this is one announcement EV buyers and manufacturers have been waiting for. With a series of customs duty exemptions targeting lithium-ion battery production, the government has made a clear push toward lowering EV costs and strengthening domestic manufacturing.

.webp)

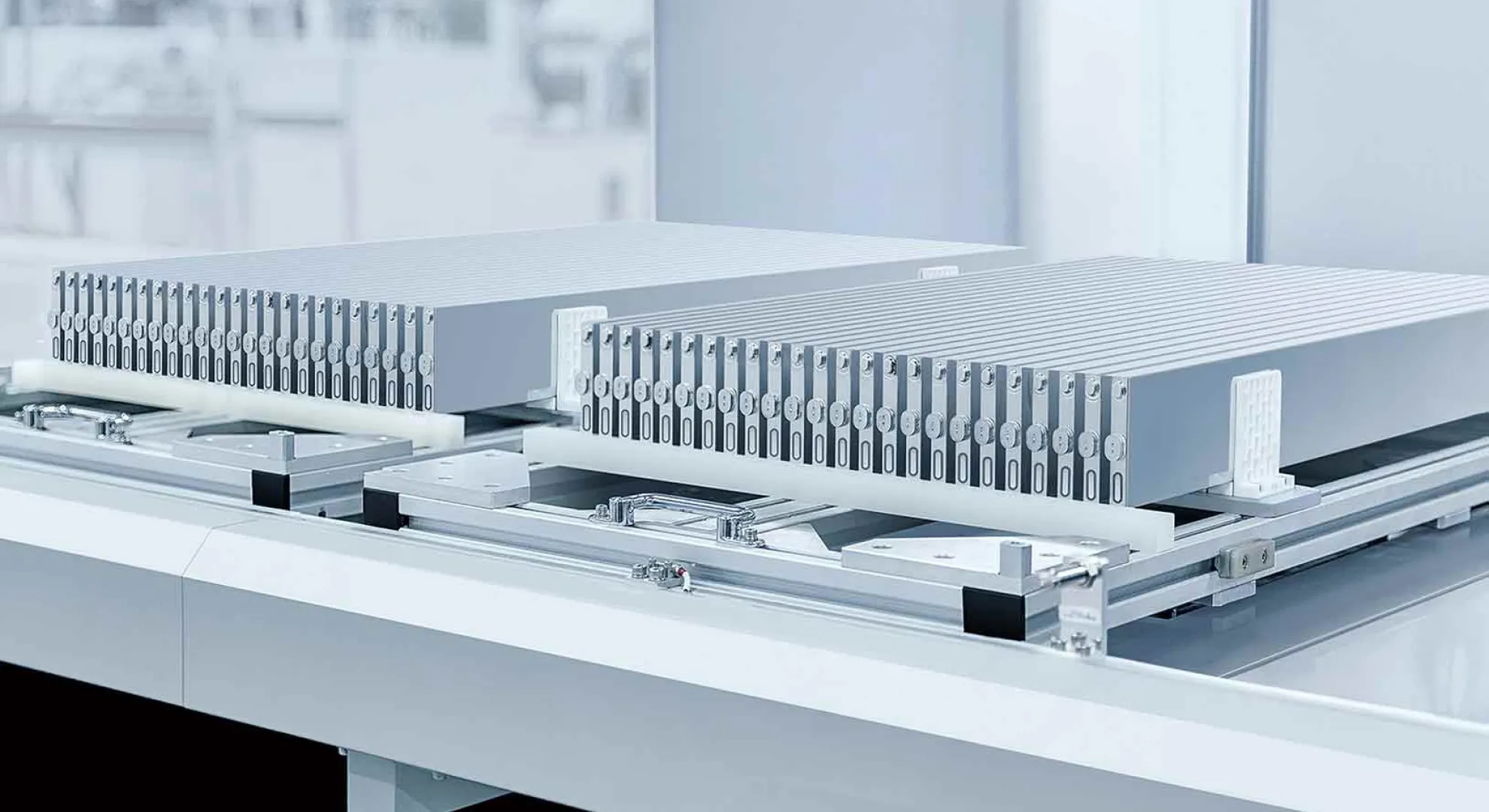

Customs Duty Relief for Lithium-Ion Battery Manufacturing

One of the most impactful announcements in the budget is the exemption of 63 capital goods used in lithium-ion battery manufacturing from Basic Customs Duty. These capital goods largely include specialized machinery essential for battery cell production, which previously added significantly to manufacturing costs.

In addition to this, the Finance Minister proposed adding 35 more capital goods specifically used for EV battery manufacturing to the duty-free list. By easing the cost burden on manufacturers, the government is laying the groundwork for cheaper and more competitive battery production within India.

From my perspective, this move strengthens India’s long-term goal of becoming a global EV manufacturing hub rather than just an assembly market.

Zero Duty on Cobalt Powder and Critical Minerals

Raw materials remain one of the biggest cost drivers for batteries, and the budget directly addresses this challenge. The Finance Minister announced a full exemption of Basic Customs Duty on cobalt powder and cobalt waste, both of which are crucial inputs for lithium-ion batteries.

Beyond cobalt, lead, zinc, and 12 other critical minerals have also been fully exempted from customs duty. This decision is aimed at ensuring a steady and affordable supply of essential raw materials while reducing India’s reliance on imports.

In my view, securing these minerals at lower costs is just as important as machinery exemptions, because raw material volatility often decides battery pricing.

Boost to Battery Recycling and Circular Economy

Another notable step is the reduction of customs duty on lithium-ion battery scrap to nil. This move directly supports battery recycling and material recovery, making it more economical to process used batteries within India.

Encouraging recycling not only reduces environmental impact but also helps recover valuable materials like lithium, cobalt, and nickel, further stabilizing supply chains. I see this as a smart long-term play that aligns sustainability with cost efficiency.

Make-in-India Push for EV Batteries

All these duty rationalisations fall squarely under the Make-in-India initiative, with the goal of boosting domestic lithium-ion battery manufacturing. By lowering costs on machinery, raw materials, and recycling inputs, the government is creating a more self-reliant EV ecosystem.

Reduced import dependence means better price control, stronger supply chains, and faster innovation within the country. Over time, this could significantly change how affordable EVs are for Indian consumers.

What This Means for EV Buyers

By removing duties on critical inputs and production equipment, the overall cost of manufacturing EV batteries is expected to decline. While price reductions may not be immediate, these benefits are likely to be passed on gradually to consumers.

In simple terms, your next electric vehicle could become more affordable, and that’s a big win for EV adoption in India.

Frequently Asked Questions — FAQs

Q. Will EV prices reduce after Union Budget FY27?

- Yes, the reduction in battery manufacturing costs is expected to lower EV prices over time, as batteries account for a major portion of an EV’s cost.

Q. Which battery-related items were exempted from customs duty?

- The budget exempts 63 capital goods, adds 35 more EV battery machinery items, removes duty on cobalt powder and battery waste, and reduces duty on lithium-ion battery scrap to zero.

Q. How does this help EV manufacturers in India?

- Manufacturers benefit from lower machinery and raw material costs, reduced import dependence, and improved supply chain stability, making domestic production more competitive.

Q. Does this budget support battery recycling?

- Yes, by reducing customs duty on lithium-ion battery scrap to nil, the government is actively encouraging recycling and material recovery.

Q. How does this align with Make-in-India?

- The measures promote local manufacturing of lithium-ion batteries, reduce reliance on imports, and strengthen India’s EV and energy storage ecosystem.