Electric vehicles (EVs) continue to reshape the automotive industry, with increasing sales, government incentives, and advancing technology. Investors looking to capitalize on the EV revolution may find opportunities in stocks related to electric vehicle manufacturing, battery production, and charging infrastructure.

The state of the EV market

According to Cox Automotive Inc., around 1.3 million EVs were sold in the U.S. in 2024, up from 1.2 million in the previous year. With the growing adoption of EVs, investing in this sector could be appealing. However, EV stocks remain volatile, making it essential for investors to carefully assess their options.

What are EV stocks?

EV stocks cover a wide range of companies, including:

- Electric vehicle manufacturers (Tesla, Rivian, XPeng)

- Battery producers (QuantumScape, CATL, Panasonic)

- Charging station providers (ChargePoint, EVgo)

- Semiconductor and tech companies contributing to EV technology (NVIDIA, Alphabet, Texas Instruments)

- Raw material suppliers for EV components (Southern Copper, Freeport-McMoRan)

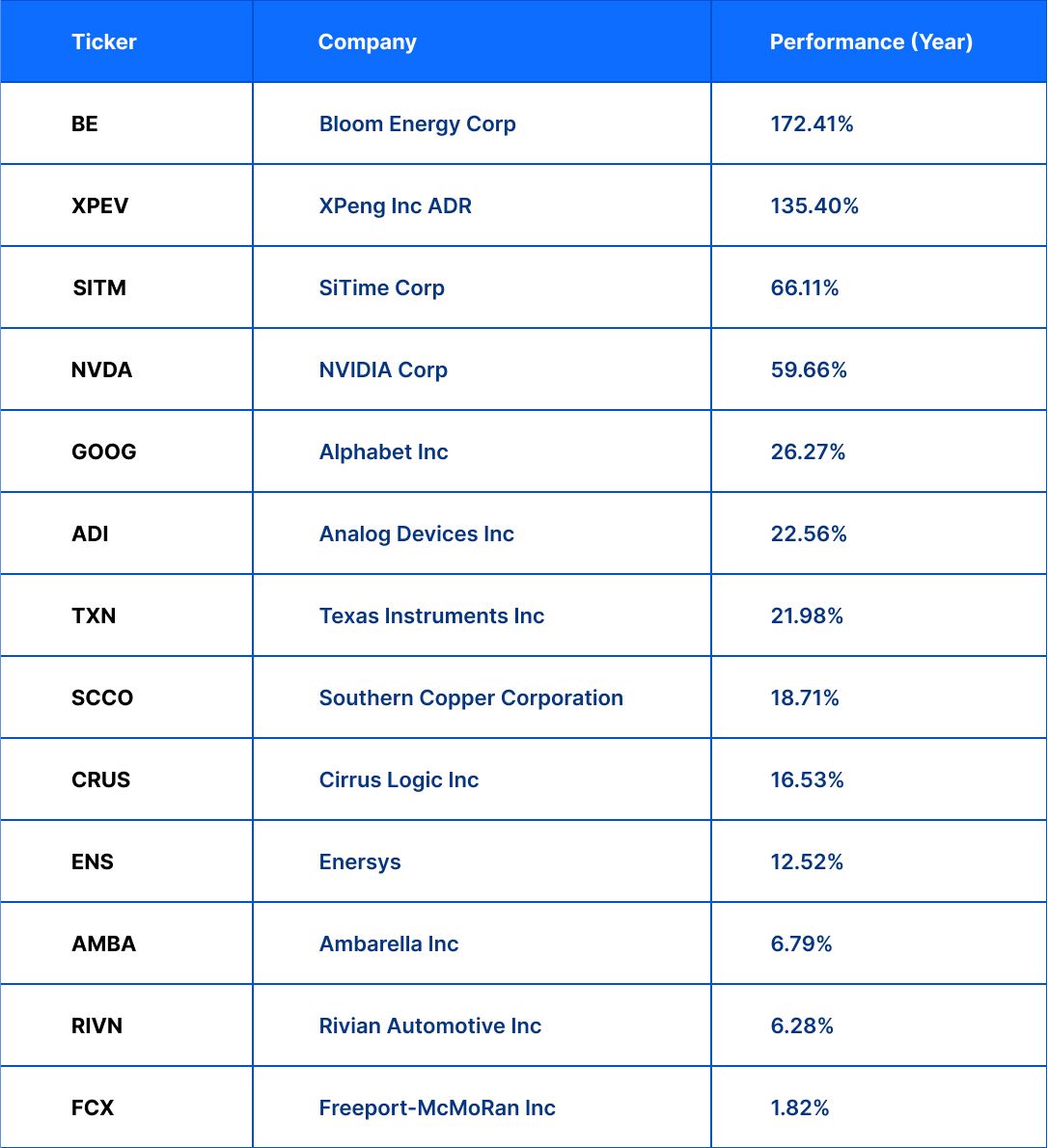

Best-performing EV stocks in March 2025

Here are the 13 best-performing stocks from the Solactive Electric Vehicles and Future Mobility Index, ranked by their one-year returns:

Source: Finviz, data as of March 3, 2025.

EV stock ETFs: a safer alternative?

If picking individual stocks seems risky, EV-focused exchange-traded funds (ETFs) offer diversified exposure. One example is the Global X Autonomous & Electric Vehicles ETF (DRIV), which tracks companies involved in EV technology and manufacturing. While ETFs reduce single-stock risk, they also limit control over specific investments.

Should you invest in EV stocks?

While EV stocks present a high-growth opportunity, they also come with volatility and regulatory uncertainties. Investors should:

- Assess financials and growth potential before investing.

- Diversify within the EV sector (manufacturers, battery tech, suppliers, etc.).

- Consider ETFs for a balanced approach.

- Stay informed on government incentives and industry trends.

The EV sector is evolving rapidly, and while high-performing stocks have delivered strong returns, market risks remain. Investors should weigh their risk appetite, conduct thorough research, and consider both individual stocks and ETFs before diving into the EV space.

Disclaimer: This blog is for informational purposes only and does not constitute financial advice. Always consult a financial professional before making investment decisions.