The Air Quality Index (AQI) in many Indian cities has worsened in recent months, with several areas experiencing dangerously high levels of pollution, especially during the winter months.

Vehicle emissions are one of the biggest factors contributing to the deteriorating air quality in India. Enter electric vehicles (EVs).

The growing interest in green number-plated vehicles in India is more than just a fad. It reflects a significant shift in consumer behavior and government policy towards sustainable and eco-friendly transportation.

In addition to this, the number of fast-charging stations is increasing everywhere. Private companies and energy providers like Tata Power, Reliance, and Indian Oil Corporation (IOC) are playing a significant role in developing a widespread network of fast-charging and battery-swapping stations.

Why invest in EV stocks?

With the increasing demand for EVs, the stocks of companies involved in EV manufacturing, battery technology, and charging infrastructure are attracting significant investor attention. Government subsidies and incentives like India's FAME II scheme further bolster their growth potential.

These stocks span a wide range of companies—from automakers producing electric vehicles to manufacturers of batteries, charging infrastructure, and related technologies.

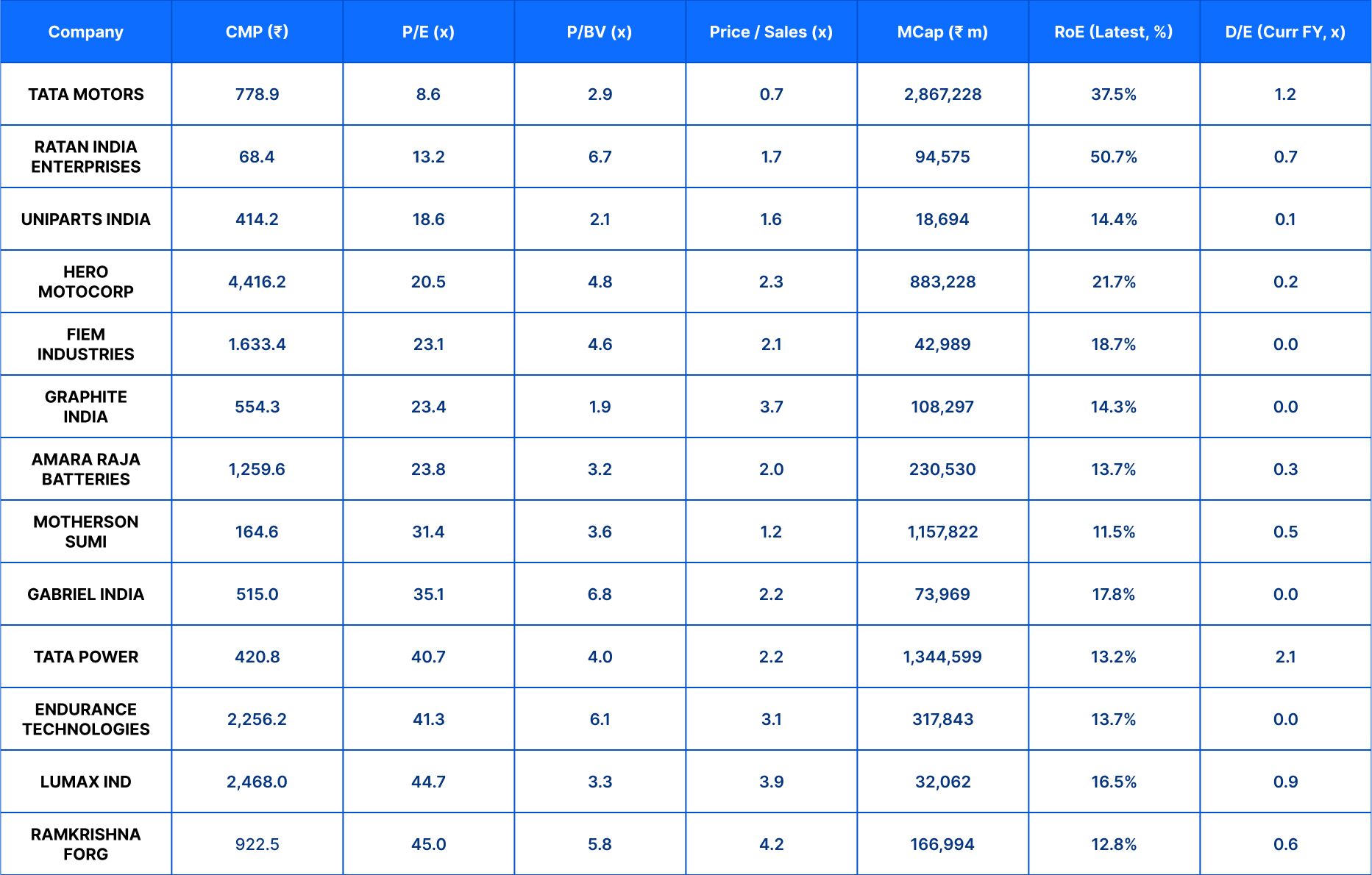

Let's look at some of the undervalued EV stocks in India that could make big moves in 2025 and beyond. These companies are filtered using Equitymaster's Powerful Stock Screener.

1. Tata Motors

Tata Motors is involved in the production of a wide range of vehicles, including passenger cars, commercial vehicles, utility vehicles, electric vehicles, and defense vehicles.

- Aiming for a 25-30% EV mix by FY25 and 50% by FY30.

- Offers EV models like the Tata Nexon EV and plans to launch Harrier EV, Sierra EV, and more by late 2025.

- Premium EV models, including an electric Jaguar, are also in the pipeline.

- Stock Valuation:

- PE Multiple: 8.6x (Industry P/E: 8.3x)

- Price-to-Book Value: 2.9x

- EV/EBITDA: 5.4x

- Tata Motors plans to launch 10 new EV models by FY26 to strengthen its market position in India's growing EV segment.

2. RattanIndia Enterprises

RattanIndia Enterprises is a diversified Indian company operating in EVs, e-commerce, fintech, and drones.

Acquired a significant stake in Revolt Motors, India's leading AI-driven electric motorcycle manufacturer.

- Key models: Revolt RV400, RV1, and RV1+ (affordable commuter-friendly e-bikes).

- Expanding the dealership network, with 154 locations and 14 more planned by December 2025.

- Entered Sri Lanka market in late 2024 with plans for further global expansion in 2025.

3. Hero MotoCorp

Hero MotoCorp, one of the world's largest two-wheeler manufacturers, is making significant moves in the EV sector through VIDA, its dedicated EV brand.

- VIDA's recent performance: 11,600 retail sales during the 32-day festive period (Oct-Nov 2024).

- Expanding the VIDA network via Hero Premia and Hero 2.0 outlets.

- Competing with leading players like Ola Electric, TVS, and Ather Energy in the electric two-wheeler segment.

4. Samvardhana Motherson

Samvardhana Motherson is a global player in automotive and non-automotive sectors, focusing on innovative and sustainable EV solutions.

- Specializes in high-voltage wiring, battery components, and lightweight parts for electric and hybrid vehicles.

- Acquired an 11% stake in REE Automotive, a developer of modular EV platforms.

- Strengthening its position in global EV supply chains.

5. Tata Power

Tata Power is one of India's largest integrated power companies and a leader in EV charging infrastructure.

- Operates over 100,000 home chargers, 5,500+ public and fleet charging points, and 1,100 bus charging stations across 530 cities in India.

- Branded EV charging network: EZ Charge.

- Plans to expand renewable energy initiatives to support the EV ecosystem.

EV stocks are considered high-growth, ethical investments, attracting both retail and institutional investors. However, investors must conduct thorough due diligence and assess corporate governance before investing.

Data Source: Equitymaster’s Stock Screener With India's EV revolution gaining momentum, these undervalued stocks have the potential for a significant upside in 2025 and beyond.