India’s electric mobility revolution is charging ahead, powered by lithium-ion batteries that are rapidly becoming central to the nation’s clean energy infrastructure. As the number of electric vehicles, grid storage systems, and portable electronics grows, so too does the challenge of managing end-of-life batteries. The Indian government and industry stakeholders are setting ambitious goals for “zero waste” recycling—a vision where every component of a used battery is recovered and reused, creating a closed-loop ecosystem.

However, experts caution that the ideal of zero waste, while inspiring, must be understood in practical and scientific terms. According to Shubham Vishvakarma, Founder and Chief of Process Engineering at Metastable Materials, a process engineering firm specializing in sustainable battery recycling, the true goal should not be complete waste elimination but maximized material recovery and responsible residue management.

Zero Waste: An Engineering Challenge, Not an Absolute Ideal

“Zero waste,” in the context of industrial recycling, is often misunderstood as the complete elimination of residues. In practice, Vishvakarma explains, it means recovering all valuable materials and ensuring that any by-products are either reused or disposed of safely. Every recycling process produces some amount of unavoidable residue—be it escaped dust, degraded solvents, or filter cakes.

In the case of lithium-ion batteries, achieving absolute zero waste is nearly impossible because the recycling process involves multiple stages of material separation, chemical reactions, and purification—all of which inherently generate trace by-products. Instead, the focus should be on engineering solutions that minimize losses and ensure safe handling of residues, creating a system that is both efficient and sustainable.

The Science of Recovery: How Recycling Works

Modern battery recycling technologies are capable of recovering a significant portion of critical metals. Techniques like hydrometallurgy and carbothermal reduction—the latter being the proprietary method developed by Metastable Materials—can achieve recovery rates of over 95% for copper and lithium, and more than 90% for nickel and cobalt.

However, the journey from recovered metals back into usable cathode materials involves further refining, during which additional material loss can occur. This underscores the importance of improving downstream refining capabilities, not just extraction processes.

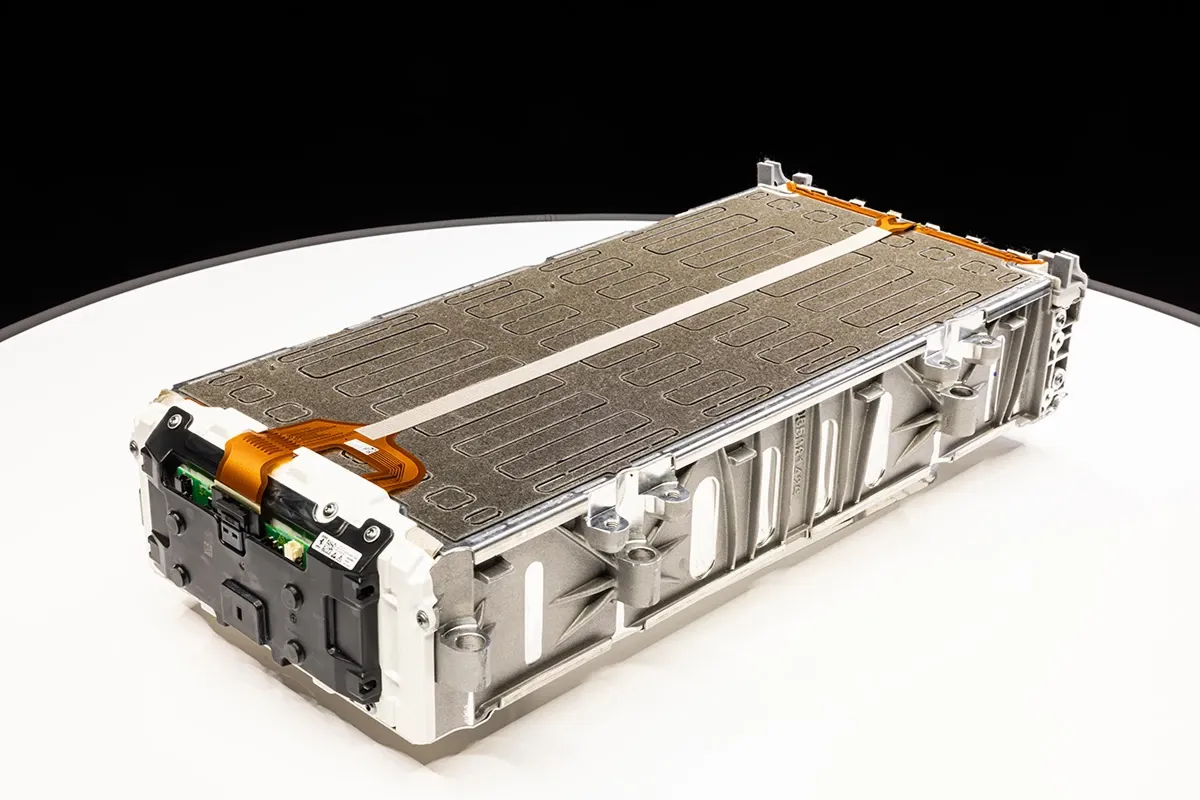

Each stage of recycling presents complex challenges. Spent lithium-ion batteries arrive at facilities in mixed chemistries and formats, often welded or glued together for safety. These must be safely dismantled, their electrolytes neutralized, and plastics, metals, and active materials separated. Depending on the method used, different trade-offs emerge:

- Pyrometallurgy effectively recovers metals like nickel, cobalt, and copper but sacrifices lithium and graphite to slag.

- Hydrometallurgy enables lithium recovery but relies on chemical reagents that generate neutralized effluents requiring proper disposal.

Balancing these trade-offs remains one of the most critical engineering challenges for recyclers aiming to close the loop on battery materials.

India’s Recycling Landscape: Between Formal and Informal Systems

India’s recycling ecosystem is still maturing, operating within a dual structure of formal and informal sectors. The formal recycling industry—licensed facilities with traceable processes—coexists with a vast informal network of collectors and handlers, where batteries often pass through unregistered channels. Small battery modules from electronics, for example, frequently end up in e-waste streams that never reach authorized recyclers.

This fragmented supply chain makes it difficult to maintain consistent feedstock volumes and traceability—both crucial for economic viability and environmental compliance. To achieve scalable and sustainable recycling, integration between these systems is essential.

Economic Realities: High Costs and Market Volatility

Battery recycling is a capital-intensive, volume-dependent sector. The economics depend heavily on commodity market prices for metals such as lithium, cobalt, and nickel. When global prices dip, high-yield recovery operations become less profitable, discouraging investment.

Achieving “zero waste” recycling, therefore, requires more than technological breakthroughs—it demands steady feedstock supply and predictable pricing mechanisms. Policies that encourage recycling through incentives, mandates, and market stability are key to bridging the gap between aspiration and execution.

Policy Support: Battery Waste Management Rules 2022

The introduction of India’s Battery Waste Management Rules (2022) marked a pivotal policy shift. These regulations mandate Extended Producer Responsibility (EPR), requiring manufacturers to trace batteries from production to end-of-life recycling via a national portal. Producers are accountable for ensuring that batteries are properly collected and processed by authorized recyclers.

However, experts point out that the current regulations apply uniform recovery targets across different battery chemistries—such as Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC)—even though they differ greatly in metal value and recovery yield. This uniformity can distort economic incentives, as LFP batteries, with lower-value metals, are less profitable to recycle under the same recovery targets.

Vishvakarma suggests a more granular regulatory approach—tracking material flow through mass balance verification, ensuring transparency on the quantities entering and leaving recycling facilities, and verifying how residues are handled.

Strategic Alignment: Linking Recycling to Critical Mineral Security

As India develops its National Critical Minerals Mission 2025, integrating battery recycling data could turn waste management into a strategic resource initiative. By treating used batteries as secondary sources of critical minerals like lithium, cobalt, and nickel, India can reduce its dependence on imports and enhance supply chain resilience.

The government’s ₹1,500 crore recycling incentive scheme is a step in this direction. Additionally, industry advocates propose mandating a minimum percentage of recycled metals in new battery production—a move that would stabilize demand for recovered materials and encourage local processing capacity.

Learning from the Oil Industry: Building Capacity Ahead of Demand

A compelling analogy lies in India’s petroleum sector. Decades before discovering significant crude reserves, India invested heavily in refining infrastructure, eventually becoming a global refining hub. A similar approach in battery recycling could position India as a regional circular economy leader—importing spent batteries, refining materials domestically, and exporting value-added products to global markets.

Measuring Circularity: Beyond the 100% Ideal

Metastable Materials emphasizes that true circularity should be measured not by the absence of waste, but by accountability and material efficiency. Key performance indicators could include:

- Metal-specific recovery rates (for lithium, nickel, cobalt, and copper)

- Residue treatment compliance and reuse rates

- Carbon and water footprints per tonne of recovered material

These metrics provide a more transparent and scientifically grounded measure of sustainability than the aspirational yet impractical “100% recovery” claims.

Toward a Responsible Circular Future

Every tonne of recycled battery material reduces the environmental burden of new mining and cuts foreign exchange outflows for critical minerals. More importantly, it strengthens India’s position in the global energy transition.

The road to zero waste is not about eliminating every residue—it is about ensuring that every valuable gram is recovered, and no harmful substance escapes into the environment. Under this redefined vision, zero waste becomes not a utopian dream, but an engineering and policy challenge—one that India’s recyclers, scientists, and policymakers are increasingly prepared to tackle.

As lithium-ion batteries continue to drive India’s clean energy ambitions, achieving a balanced, realistic, and accountable recycling ecosystem will be essential for true circularity.