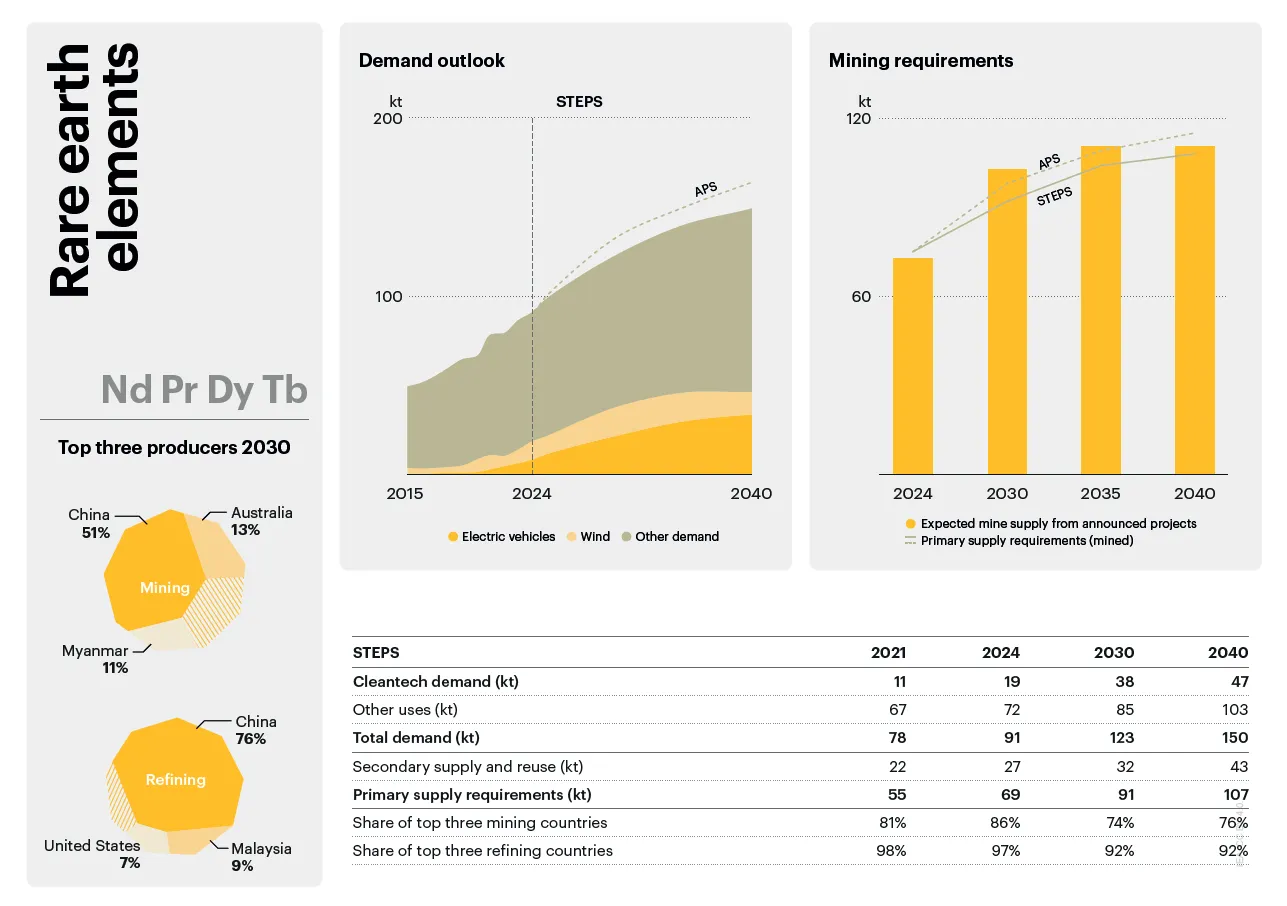

While India has EV battery manufacturing plants, we are still in the nascent stages of building a robust domestic supply chain for lithium-ion batteries. While initiatives, like Ola’s ‘Made-in-India’ ferrite motor which don’t use Chinese components at all and lithium-ion battery manufacturing plant, are a great stepping stone to building a better supply chain, India still lacks the infrastructure to extract these rare-earth minerals from our own country. Reports have shown that India has a high reserve of these rare-earth magnets, but the lack of technology has made it unusable. Even though India has a large reserve of rare earths, particularly in coastal and monazite-rich areas, a significant portion of this remains untouched due to regulatory restrictions, inadequate infrastructure for refining, and a shortage of capacity for producing high-end magnets.

Which is why, Indian manufacturers rely heavily on imports from China for EV batteries. This is also the reason why these batteries are so hard to replace and make up a huge portion of the cost of the vehicle.

Let’s understand how China is so far ahead in terms of this technology and how India can catch up to them as quickly as possible.

.webp)

China’s EV Market

With the trade wars behind us, it is time to dive deep into how China’s electrification has given them a global monopoly for the exports of EV battery cells. So much so, that when China imposed trade restrictions on the export of rare-earth magnets, the global EV industry suffered greatly.

Currently, China makes up more than half of EV sales globally, with Chinese companies making sleek and affordable electric cars with no barriers. Within the Chinese EV market, the race isn’t about who can make the fastest car or the car with the longest range. There, the fight is for affordability and tech, and we can track EV battery innovations with every new launch in China.

Secret to Success — Government Support & Subsidies

The first major reason for why Chinese companies have been able to develop their EV battery is due to a huge amount of support from the Chinese government.

Nearly two decades ago, China was well on its way to become the world’s largest importer of oil, so electrifying their car fleet would help it become energy independent. Not to mention the growing pollution in China’s major cities, a huge reason being the car emissions.

The then-Head of Ministry of Science and Technology, Wan Gang, was a big believer in electric vehicles and knew that Chinese companies could never compete on ICE (internal combustion engine) technology. It was this belief that made him push multiple policies that supported the “new energy vehicles”. They provided substantial subsidies which estimated to upward of $29 billion from 2009 to 2022. This came in the form of subsidies, research spending and tax breaks which significantly boosted the EV industry. In addition to this, the policies made it easier for companies to take cheap loans from state-owned banks and even get cheap land leases from the government.

In 2009, the government also gave Chinese companies an instant market by contracting them to electrify their bus and taxi fleets. Shenzhen, a city near Hong Kong, had their entire bus fleet of 16,000 buses electrified by BYD — much before it became the world’s largest EV company.

To get customers on board, government offered them generous subsidies as well, along with other benefits. This included discounts on charging, favorable parking, and much more.

Home-made EV Battery — A Step in the Right Direction

But surely, the battery wasn’t very good in those early days. To tackle this, the Chinese government started introducing stricter standards for EV batteries, rating them based on battery density, and offering further incentives for higher density batteries.

Eventually, consumer EV sales in China exploded. To protect its own interest, China introduced a new rule. For foreign sellers like GM and Tesla, who wanted to sell their cars in China, the government made a rule that their cars must use Chinese-made batteries to qualify for consumer subsidies.

China phased out these consumer subsidies in 2022, but the demand has already been created. With 6 million EV sales in China, they already accounted for half of all global sales. In 2024, over half of new car sales in China were electric.

Supply Chain Dominion

Another aspect of this journey is the supply chain for the battery components.

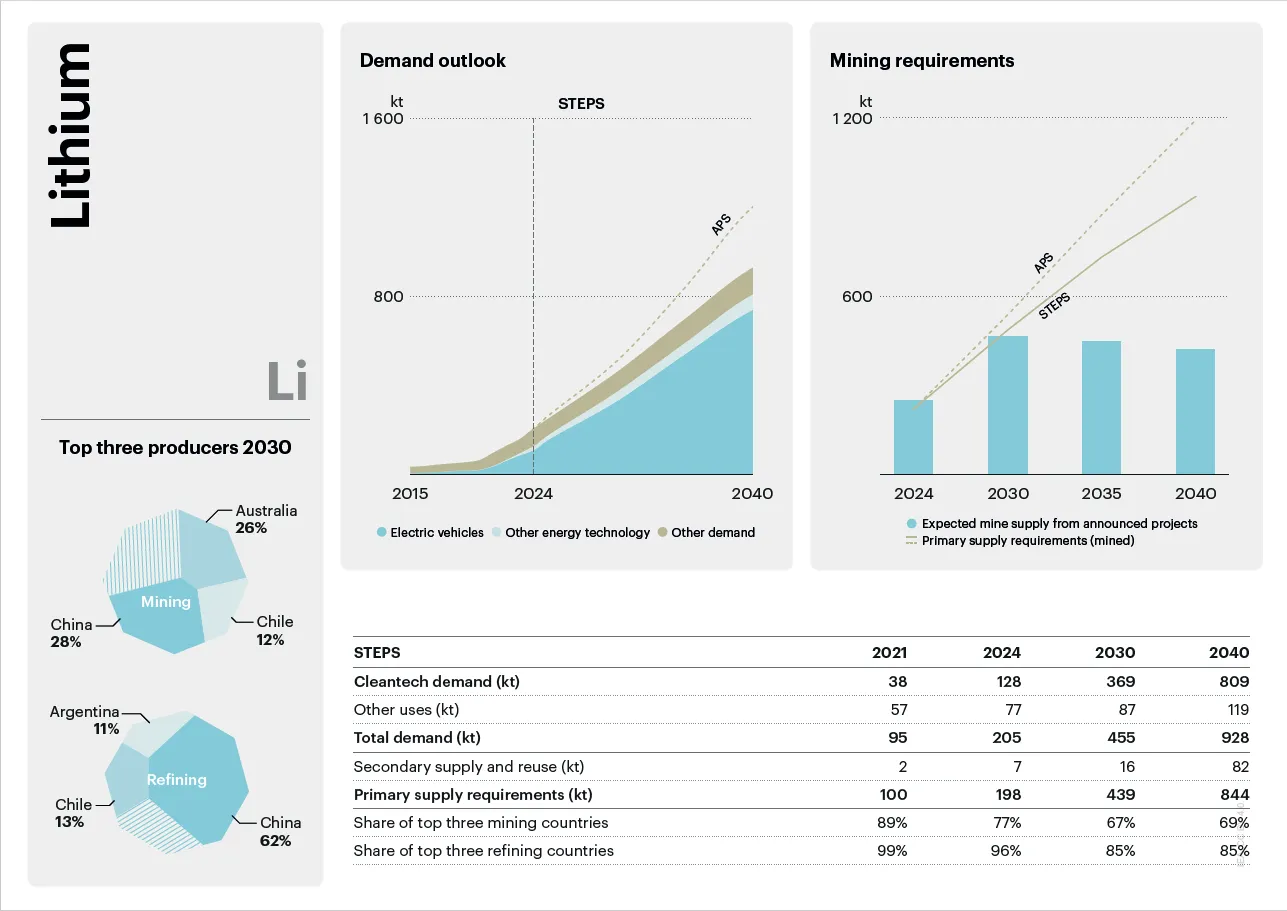

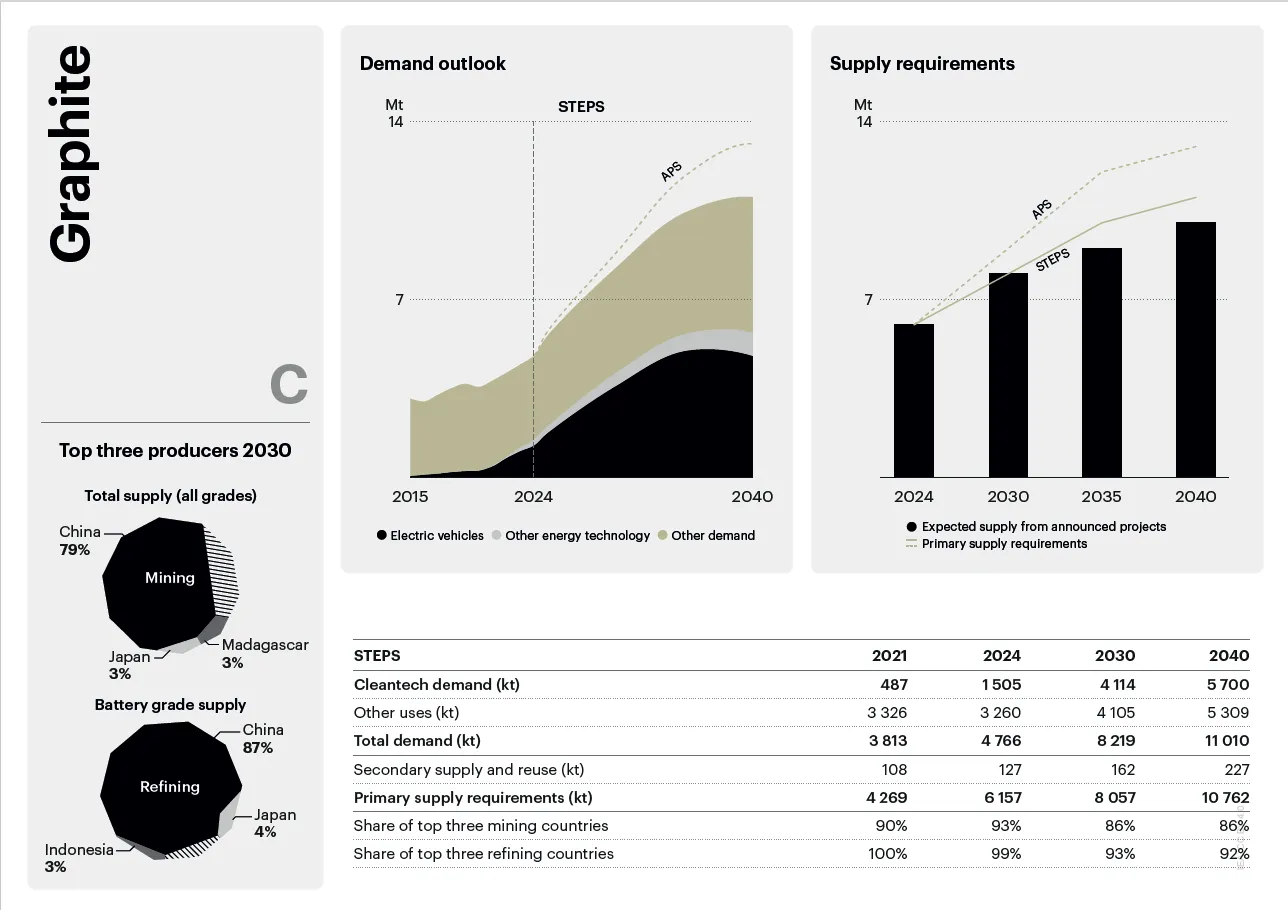

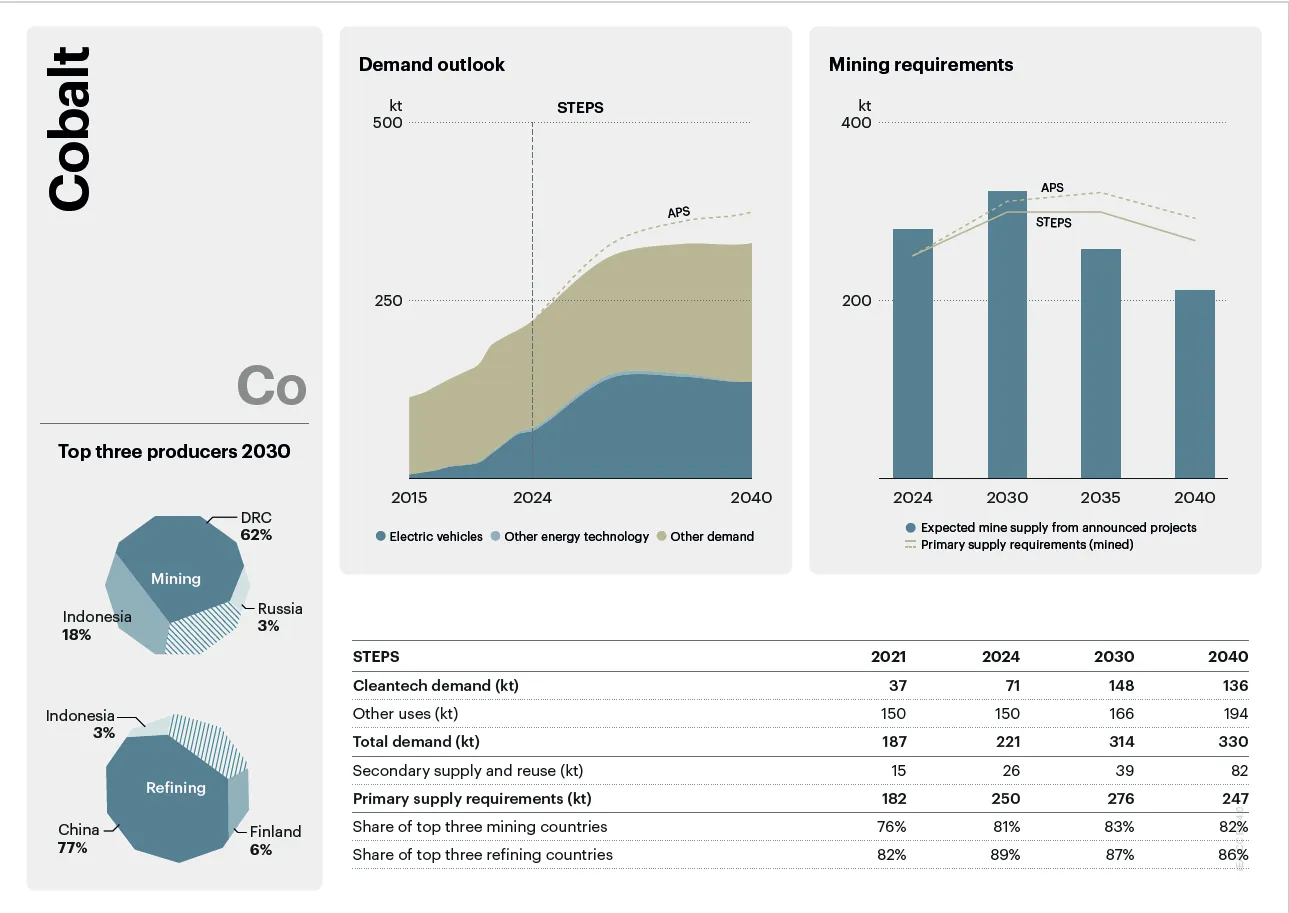

EV batteries are made up of Lithium-ion cells. They’re made up of a cathode, anode, and electrolyte and a separator. The cathode is made of Nickel, Manganese and Cobalt (NMC batteries) or of Lithium, Iron, and Phosphate (LFP batteries). The anode is made of graphite and the electrolyte is lithium. This electrolyte is the reason we call them Lithium-ion batteries.

Over the past several years, Chinese companies started acquiring ownership stakes in mines around the world where these minerals exist. Since they controlled the production, they controlled the price. Effectively, Chinese companies control significant percentages of the world’s supply of minerals needed for batteries.

China also controls the supply chain through the steps after mining. No matter who mined the minerals, china refines a vast majority of them. This is the step where factories grind down the raw mined materials and extract the desired minerals from it.

But At What Cost?

The process is very polluting, which is why most developed countries do not do it on their homelands. It is important to note that China has suffered significantly from their refining plants, which has completely destroyed the places they were based in. The cleanup and recovery alone would take around 50 to 100 years.

State media reported that around 300 million yuan, or $43 million, were distributed from the central government to the area for remediation in 2015. However, officials from the Ministry of Ecology and Environment, visiting the region in June 2018, found that local bureaus had provided false reports on the extent of replanting and erosion control, and that the total area treated so far had been exaggerated.

Apart from this, Chinese plants also manufacture the vast majority of the four components of the EV batteries — Cathode (70%), Anode (92%), the Electrolyte (78%) and the Separator (70%) — and put them together to make the battery cells (78%).

Companies were already manufacturing batteries for electronics and it was easy to switch to making batteries for EVs. BYD is one of these examples. They started producing batteries for electronics in the 90s and then got into producing EVs.

China’s EV Battery Innovation

China has long since surpassed Japan and Korea in battery manufacturing. And this dominance has allowed China to lead the world in battery innovation. The NMC batteries use expensive minerals — nickel and cobalt. To avoid using them, they made the LFP batteries with much cheaper and more abundant minerals.

In 2023, CATL, the world’s largest battery manufacturer announced an LFP battery that could power a car for 370 miles or 595 km on just a 10-minute charge. BYD has also created their own battery called the Blade Battery which is very thin and very long, so they are able to fit in more cells in the same space due to this shape.

MG, owned by SAIC Motors, has also taken a crucial step forward by introducing a semi-solid-state battery pack in the MG4, unveiled through recent patent photos filed with China’s Ministry of Industry and Information Technology (MIIT). This marks a pivotal moment, not just for MG, but for the entire automotive industry, as it signals that next-generation battery performance is becoming more accessible to the mass market.

What Should India Do Next?

India has already implemented a lot of the initial steps taken by the Chinese government and we are surely on the correct path. However, the biggest roadblock in India’s EV ambition is the heavy reliance on China for these batteries.

The rare earth episode is more than just a trade skirmish — it’s a wake-up call. It showed how a small but strategic component could hold an entire industry hostage. For India, the key takeaway is clear: resilience matters as much as scale.

Building local capacity for rare earth extraction, processing, and magnet production is no longer optional. Equally critical is diversifying imports beyond China, tapping into partnerships with countries like Australia, the US, and Vietnam that are building their own rare earth ecosystems.

The episode also underscores the need for greater industry-government coordination. Quick policy responses, such as fast-tracking subsidies and supporting R&D in advanced materials, will be essential to reducing vulnerabilities in the long run.

The lifting of the ban is undoubtedly a relief. EV production lines will restart, automakers can meet targets, and consumer deliveries will stabilize. But the deeper reminder is that overdependence on a single source is a strategic vulnerability no industry can afford.

India’s EV transition is still in its early stages. Scaling up requires not just demand incentives and charging infrastructure but also strong, secure supply chains. The rare earth crisis has handed India’s EV sector its most important lesson yet: in the race to electrify, resilience is just as important as speed.